Qudian Inc. Reports Second Quarter 2021 Unaudited Financial Results

08/24/2021

Second Quarter 2021 Operational Highlights:

- Number of outstanding borrowers[1] from loan book business as of

June 30, 2021 decreased by 3.8% to 2.9 million from 3.0 million as ofMarch 31, 2021 , as a result of the Company's deployment of a conservative and prudent strategy - Total outstanding loan balance from loan book business[2] decreased by 13.8% to RMB3.5 billion as of

June 30, 2021 , compared to the outstanding balance as ofMarch 31, 2021 - Amount of transactions from loan book business for this quarter decreased by 12.1% to

RMB3.9 billion from the first quarter of 2021; Amount of transactions serviced on open platform for this quarter decreased by 32.5% toRMB142.0 million from the first quarter of 2021 - Weighted average loan tenure for our loan book business was 4.4 months for this quarter, compared with 4.5 months in the first quarter of 2021; Weighted average loan tenure for transactions serviced on open platform was 6.2 months for this quarter, compared with 6.7 months in the first quarter of 2021

|

[1] Outstanding borrowers are borrowers who have outstanding loans from the Company's loan book business as of a particular date. [2] Includes (i) off and on balance sheet loans directly or indirectly funded by our institutional funding partners or our own capital, net of cumulative write-offs and (ii) does not include auto loans from Dabai Auto business. |

Second Quarter 2021 Financial Highlights:

- Total revenues were

RMB412 .1 million (US$63.8 million ), compared toRMB1,167.0 million from the same period of last year - Net income attributable to

Qudian's shareholders wasRMB269.9 million (US$41.8 million ), representing an increase of 50.7% from the same period of last year, orRMB1.03 (US$0.16 ) per diluted ADS - Non-GAAP net income attributable to

Qudian's shareholders[3] wasRMB282 .5 million (US$43.7 million ), representing an increase of 844.0% from the same period of last year, orRMB1.07 (US$0.17 ) per diluted ADS

|

[3] For more information on this Non-GAAP financial measure, please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release. |

"During the second quarter of 2021, we analyzed evolving market dynamics and maintained a prudent approach to our cash credit business, ultimately generating total transaction volume of approximately

"As we continued to implement stringent credit approval standards and strategically shifted toward higher-quality borrowers, our asset quality further improved and the D1 delinquency rate[4] for our loan book business decreased to below 5% at the end of the second quarter. Looking ahead, we remain dedicated to controlling credit risk in our loan book business and committed to creating and delivering value to children, families and society with our extra-curriculum activities business," said Ms.

|

[4] "D1 delinquency rate" is defined as (i) the total amount of principal and financing service fees that became overdue as of a specified date, divided by (ii) the total amount of principal and financing services fees that was due for repayment as of such date, in each case with respect to our loan book business. |

Second Quarter Financial Results

Total revenues were

Financing income totaled

Loan facilitation income and other related income decreased by 95.1% to

Transaction services fee and other related income increased to

Sales income and others decreased to

Sales commission fee decreased by 37.0% to

Total operating costs and expenses decreased by 90.9% to

Cost of revenues decreased by 82.3% to

Sales and marketing expenses decreased by 81.4% to

General and administrative expenses increased by 44.8% to

Research and development expenses decreased by 30.3% to

Provision for receivables and other assets was a reversal of

As of June 30, 2021, the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due was RMB147.5 million (

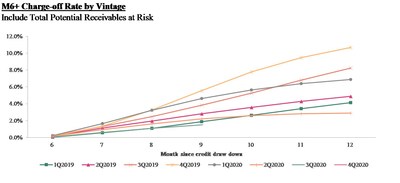

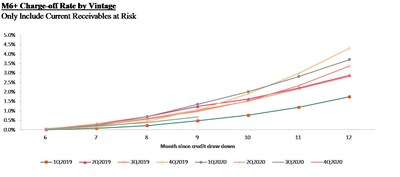

The following charts display the "vintage charge-off rate." Total potential receivables at risk vintage charge-off rate refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the total potential outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk vintage charge-off rate refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the actual outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

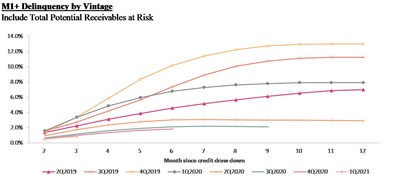

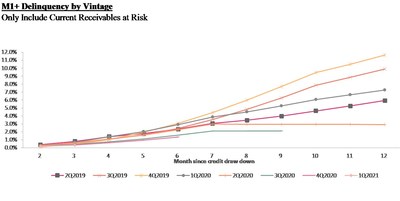

Total potential receivables at risk M1+ delinquency rate by vintage refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the total potential outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk M1+ delinquency rate by vintage refers to, with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period, the actual outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination, divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Income from operations increased to

Net income attributable to Qudian's shareholders was RMB269.9 million (

Non-GAAP net income attributable to

Cash Flow

As of

For the second quarter of 2021, net cash provided by operating activities was RMB570.3 million (

Conference Call

The Company's management will host an earnings conference call on

|

Title of Event: |

|

|

Conference ID: |

9770439 |

|

Registration link: |

For participants who wish to join the call, please complete the online registration at least 15 minutes prior to the scheduled call start time. Upon registration, participants will receive the conference call access information, including participant dial-in numbers, a Direct Event Passcode, a unique Registrant ID, and an e-mail with detailed instructions to join the conference call.

Additionally, a live and archived webcast of the conference call will be available on the Company's investor relations website at http://ir.qudian.com.

A replay of the conference call will be accessible approximately two hours after the conclusion of the live call until

|

|

+1-855-452-5696 (toll-free) / +1-646-254-3697 |

|||||

|

International: |

+61-2-8199-0299 |

|||||

|

|

800-963-117 (toll-free) / +852-3051-2780 |

|||||

|

Mainland, |

400-632-2162 / 800-870-0205 (toll-free) |

|||||

|

Passcode: |

9770439 |

|||||

About

For more information, please visit http://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income/loss, a Non-GAAP financial measure, in evaluating our operating results and for financial and operational decision-making purposes. We believe that adjusted net income/loss helps identify underlying trends in our business by excluding the impact of share-based compensation expenses, which are non-cash charges, and convertible bonds buyback income. We believe that adjusted net income/loss provides useful information about our operating results, enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Adjusted net income/loss is not defined under

We mitigate these limitations by reconciling the Non-GAAP financial measure to the most comparable

For more information on this Non-GAAP financial measure, please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company's year-end audit, which could result in significant differences from this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things, the expectation of its collection efficiency and delinquency, contain forward-looking statements.

For investor and media inquiries, please contact:

Tel: +86-592-596-8208

E-mail: ir@qudian.com

Tel: +86 (10) 6508-0677

E-mail: qudian@tpg-ir.com

Tel: +1-212-481-2050

E-mail: qudian@tpg-ir.com

|

|

|||||||

|

Unaudited Condensed Consolidated Statements of Operations |

|||||||

|

Three months ended |

|||||||

|

(In thousands except for number |

2020 |

2021 |

|||||

|

of shares and per-share data) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

||||

|

RMB |

RMB |

US$ |

|||||

|

Revenues: |

|||||||

|

Financing income |

580,856 |

311,755 |

48,285 |

||||

|

Sales commission fee |

14,404 |

9,081 |

1,406 |

||||

|

Sales income and others |

293,292 |

23,655 |

3,664 |

||||

|

Penalty fee |

19,335 |

16,569 |

2,566 |

||||

|

Loan facilitation income and other related income |

255,063 |

12,565 |

1,946 |

||||

|

Transaction services fee and other related income |

4,098 |

38,462 |

5,957 |

||||

|

Total revenues |

1,167,048 |

412,087 |

63,824 |

||||

|

Operating cost and expenses: |

|||||||

|

Cost of revenues |

(366,381) |

(64,890) |

(10,050) |

||||

|

Sales and marketing |

(156,806) |

(29,140) |

(4,513) |

||||

|

General and administrative |

(75,334) |

(109,112) |

(16,899) |

||||

|

Research and development |

(56,265) |

(39,204) |

(6,072) |

||||

|

Changes in guarantee liabilities and risk assurance liabilities(1) |

191,420 |

55,624 |

8,615 |

||||

|

Provision for receivables and other assets |

(519,014) |

97,385 |

15,083 |

||||

|

Total operating cost and expenses |

(982,380) |

(89,337) |

(13,836) |

||||

|

Other operating income |

127,698 |

4,482 |

694 |

||||

|

Income from operations |

312,366 |

327,232 |

50,682 |

||||

|

Interest and investment income/(loss), net |

(65,758) |

17,713 |

2,743 |

||||

|

Foreign exchange income, net |

4,960 |

319 |

49 |

||||

|

Other income |

10,059 |

85 |

14 |

||||

|

Other expenses |

(94) |

(750) |

(116) |

||||

|

Net income before income taxes |

261,533 |

344,599 |

53,372 |

||||

|

Income tax expenses |

(82,371) |

(75,457) |

(11,687) |

||||

|

Net income |

179,162 |

269,142 |

41,685 |

||||

|

Less: net loss attributable to non-controlling |

- |

(805) |

(124) |

||||

|

Net income attributable to |

179,162 |

269,947 |

41,809 |

||||

|

Earnings per share for Class A and Class B |

|||||||

|

Basic |

0.71 |

1.07 |

0.17 |

||||

|

Diluted |

0.68 |

1.03 |

0.16 |

||||

|

Earnings per ADS (1 Class A ordinary share |

|||||||

|

Basic |

0.71 |

1.07 |

0.17 |

||||

|

Diluted |

0.68 |

1.03 |

0.16 |

||||

|

Weighted average number of Class A and Class B |

|||||||

|

Basic |

253,724,694 |

253,370,503 |

253,370,503 |

||||

|

Diluted |

272,190,273 |

266,973,780 |

266,973,780 |

||||

|

Other comprehensive loss: |

|||||||

|

Foreign currency translation adjustment |

(10,165) |

(7,087) |

(1,098) |

||||

|

Total comprehensive income |

168,997 |

262,055 |

40,587 |

||||

|

Less: total comprenhensive loss attributable to |

- |

(805) |

(124) |

||||

|

Total comprehensive income attributable to |

168,997 |

262,860 |

40,711 |

||||

|

Note: |

|||||||

|

|

||||||

|

Unaudited Condensed Consolidated Balance Sheets |

||||||

|

As of |

As of |

|||||

|

(In thousands except for number |

2021 |

2021 |

||||

|

of shares and per-share data) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||

|

RMB |

RMB |

US$ |

||||

|

ASSETS: |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

2,187,502 |

3,133,623 |

485,336 |

|||

|

Restricted cash |

234,112 |

296,915 |

45,986 |

|||

|

Short-term investments |

5,079,154 |

5,024,942 |

778,264 |

|||

|

Short-term loan principal and financing service fee receivables |

3,515,293 |

3,150,299 |

487,919 |

|||

|

Short-term finance lease receivables |

128,830 |

88,805 |

13,754 |

|||

|

Short-term contract assets |

50,077 |

26,422 |

4,092 |

|||

|

Other current assets |

1,006,670 |

679,604 |

105,258 |

|||

|

Total current assets |

12,201,638 |

12,400,610 |

1,920,609 |

|||

|

Non-current assets: |

||||||

|

Long-term finance lease receivables |

11,795 |

3,818 |

591 |

|||

|

Operating lease right-of-use assets |

296,253 |

526,259 |

81,507 |

|||

|

Investment in equity method investee |

381,287 |

367,148 |

56,864 |

|||

|

Long-term investments |

243,668 |

243,668 |

37,739 |

|||

|

Property and equipment, net |

359,955 |

436,007 |

67,529 |

|||

|

Intangible assets |

8,926 |

8,733 |

1,353 |

|||

|

Long-term contract assets |

10,317 |

6,154 |

953 |

|||

|

Deferred tax assets, net |

119,138 |

68,231 |

10,568 |

|||

|

Other non-current assets |

425,464 |

463,042 |

71,717 |

|||

|

Total non-current assets |

1,856,803 |

2,123,060 |

328,821 |

|||

|

TOTAL ASSETS |

14,058,441 |

14,523,670 |

2,249,430 |

|||

|

|

||||||

|

Unaudited Condensed Consolidated Balance Sheets |

||||||

|

As of |

As of |

|||||

|

(In thousands except for number |

2021 |

2021 |

||||

|

of shares and per-share data) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||

|

RMB |

RMB |

US$ |

||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

||||||

|

Current liabilities: |

||||||

|

Short-term lease liabilities |

41,543 |

51,388 |

7,959 |

|||

|

Accrued expenses and other current liabilities |

351,417 |

415,047 |

64,283 |

|||

|

Guarantee liabilities and risk assurance liabilities(1) |

21,583 |

3,252 |

504 |

|||

|

Income tax payable |

100,054 |

34,354 |

5,320 |

|||

|

Total current liabilities |

514,597 |

504,041 |

78,066 |

|||

|

Non-current liabilities: |

||||||

|

Deferred tax liabilities, net |

18,564 |

12,182 |

1,887 |

|||

|

Convertible senior notes |

827,555 |

817,685 |

126,643 |

|||

|

Long-term lease liabilities |

152,184 |

369,666 |

57,254 |

|||

|

Long-term borrowings and interest payables |

145,312 |

145,312 |

22,506 |

|||

|

Total non-current liabilities |

1,143,615 |

1,344,845 |

208,290 |

|||

|

Total liabilities |

1,658,212 |

1,848,886 |

286,356 |

|||

|

Shareholders' equity: |

||||||

|

Class A Ordinary shares |

132 |

132 |

20 |

|||

|

Class B Ordinary shares |

44 |

44 |

7 |

|||

|

Treasury shares |

(368,681) |

(352,533) |

(54,600) |

|||

|

Additional paid-in capital |

4,014,320 |

4,010,672 |

621,174 |

|||

|

Accumulated other comprehensive loss |

(49,160) |

(56,247) |

(8,711) |

|||

|

Retained earnings |

8,793,741 |

9,063,688 |

1,403,786 |

|||

|

Total Qudian Inc. shareholders' equity |

12,390,396 |

12,665,756 |

1,961,676 |

|||

|

Non-controlling interests |

9,833 |

9,028 |

1,398 |

|||

|

Total equity |

12,400,229 |

12,674,784 |

1,963,074 |

|||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

14,058,441 |

14,523,670 |

2,249,430 |

|||

|

Note: |

||||||

|

|

|||||||

|

Unaudited Reconciliation of GAAP And Non-GAAP Results |

|||||||

|

Three months ended |

|||||||

|

2020 |

2021 |

||||||

|

(In thousands except for number |

(Unaudited) |

(Unaudited) |

(Unaudited) |

||||

|

of shares and per-share data) |

RMB |

RMB |

US$ |

||||

|

Total net income attributable to |

179,162 |

269,947 |

41,809 |

||||

|

Add: Share-based compensation expenses |

20,269 |

12,505 |

1,937 |

||||

|

Less: Convertible bonds buyback income |

169,511 |

- |

- |

||||

|

Non-GAAP net income attributable to |

29,920 |

282,452 |

43,746 |

||||

|

Non-GAAP net income per share—basic |

0.12 |

1.11 |

0.17 |

||||

|

Non-GAAP net income per share—diluted |

0.12 |

1.07 |

0.17 |

||||

|

Weighted average shares outstanding—basic |

253,724,694 |

253,370,503 |

253,370,503 |

||||

|

Weighted average shares outstanding—diluted |

253,724,694 |

266,973,780 |

266,973,780 |

||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/qudian-inc-reports-second-quarter-2021-unaudited-financial-results-301361288.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/qudian-inc-reports-second-quarter-2021-unaudited-financial-results-301361288.html

SOURCE